The principle part of getting additional security will reliably be to guarantee the people you care about if something were to happen to you. What measure of capital would you need to deal with commitments, maintain your loved ones, or to manage all of your issues?

After you fathom what needs you should guarantee through additional security it is really easy to choose the correct proportion of incorporation.

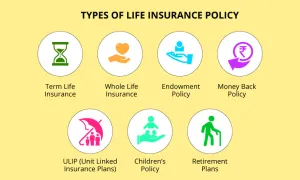

What Type Of Life Insurance

The accompanying request is what sort of consideration will best serve your necessities. To get the ideal proportion of incorporation you similarly need to guarantee that the charges fit peacefully into your monetary arrangement.

Term Insurance Benefits

Term insurance is more moderate than whole life inclusion since you are renting the security. Your incorporation is seen as unadulterated insurance for the present circumstance since it doesn’t make cash regard or participate in association benefits.

Or maybe it grants you to get the ideal proportion of security for the most moderate charges available. Term assurance has similarly advanced overtime to bring to the table more thorough decisions. You can get an appearance of-costs system where you pay more during the life of the methodology, yet the protection organization limits the total of your rushes the completion of the fixed term.

There are in like manner term courses of action that license you to make sure about your age and prosperity for the remainder of your life, so you can have the incorporation and charges made sure about for the rest of your life. This is an unprecedented and sensible way to deal with getting interminable assurance.

How Long Should You Lock In Your Premiums

The more you can make sure about your costs the more priceless it will be as time goes on. The protection organization considers the mortality risk during the level season of the term. In case you are 35 and you get a level 20-term methodology, by then the rates will be fixed until you are 55. In addition, since you are making sure about the charges at a more energetic age, the ordinary threat and rates will be not actually in the event that you some way or another ended up making sure about your costs at 55.

A considerable number of individuals have an insurance need that will last all through the rest of their lives. If you can perpetually make sure about a section of your assurance at a more young age this can save you extensively on costs. It happens consistently where people ought to apply for new incorporation after the fixed rates on their current methodology have ended and considering the way that they are as of now more settled and need to pay generously more in costs.

Your prosperity is also made sure about when you first take the game plan out. Various people looking for insurance in their fifties or sixties are dealing with a type of sickness that makes the cost of additional security twofold or triple in cost. The very reasoning that applies to making sure about your age is similarly worthy to recall while making sure about your prosperity. We haven’t the faintest idea what will befall us, and if we have our assurance made sure about, by then our insurability and costs will be unaffected by a clinical event.

Level Term Insurance

I by and large recommend getting a level-term procedure as opposed to one that will start lower and augmentation expenses each and every year. The level term systems grant you to make sure about your age and prosperity for the remainder of the term, however, the extending premium courses of action become all the more expensive reliably subject to your new age.

Since term insurance is a more moderate way to deal with get the ideal proportion of confirmation, I acknowledge that it is the right choice for a tremendous larger piece of people looking at life inclusion.

Cash Value Life Insurance: When To Consider It

Beginning A Word Of Caution About How The Life Insurance Industry Operates

An expert who pushes one association over the others is doing their clients harm. Every association has its positives and negatives and every association has focused on explicit economics to endeavor to make a genuine edge. There are 17 fiasco insurance associations in the fortune 500 alone. These associations have generally equivalent to hypothesis portfolios and lead businesses in habits that are more ordinary than not. Eight of these associations are normal, nine are stock associations, and they all work to make an advantage. The primary concern that anybody can do is to have an expert who can help them shop the market for the association that will meet their necessities best. Somebody that is a smoker with hypertension will have better options outside of the associations that target nonsmokers without illnesses. Finding the most reasonable association accessible for your age and prosperity can save you a considerable number of dollars.

I used to work for an assurance association where we just sold a single triple-A-evaluated protection organization. Exactly when I worked for this association, my fellow trained professionals and I were specially educated with the benefits of this current association’s whole life inclusion. The current situation isn’t unprecedented.